About Us

Company Profile

Welcome to Sriya Enterprise (Training That Sticks. Compliance That Clicks): Your Trusted Partner in International Trade and Compliance Navigating the world of international trade can be challenging, but you don’t have to do it alone. At Sriya Enterprise, we specialize in empowering exporters, startups, SMEs, and women entrepreneurs to succeed globally. From FEMA compliance to Trade Finance solutions, we provide tailored support to meet your business goals.

About Company

Sriya Enterprise

Sriya Enterprises is an independent advisory firm specializing in Trade Finance, International Trade Compliance, and FEMA/RBI regulatory advisory. Our comprehensive services cater to the diverse needs of businesses, with a focus on empowering MSMEs and enterprises engaged in global trade.

Our holistic approach combines technical expertise, practical insights, and a client- focused perspective. We ensure that businesses not only stay compliant but also leverage trade finance and international regulatory frameworks for sustainable growth.

Whether you’re expanding globally or seeking to strengthen operational efficiency,Sriya Enterprises is your trusted partner in achieving success in the international trade landscape.

We have partnered with multiple national and international organizations (UK, UAE) to deliver specialized training for leading banks, fintech firms, and corporate clients

on various topics of Digitisation in Banking, Trade Finance, Basic of Finance, Fintech, Treasury, etc .

Additionally, we at Sriya Enterprise also conduct open as well as captive sessions for a diverse audience—including large corporates, SMEs, and MNCs—on critical topics such as EDPMS, IDPMS, and trade compliance.

About Founder

Swati Panji

Swati Panji is a seasoned Trade Finance and FEMA Consultant, Trainer, and Industry Retainer with an exceptional track record rooted in her distinguished career in banking. After serving over a decade in varied banking roles across geographies, Swati transitioned seamlessly into the consultancy landscape. Her credentials are unparalleled: she is a Certified Trade Finance Professional (CTFP), a Certified Digital Transformation Specialist (CDTS), and holds certifications as an MLETR and NISM Credit Underwriter. These achievements underline her commitment to continuous learning and her dedication to mastering the evolving world of finance.

Swati specializes in enabling businesses to navigate the intricate landscape of international trade, compliance, and risk management. Her hands-on approach and analytical rigor have made her a trusted advisor for companies confronting the challenges of regulatory frameworks such as FEMA and the guidelines set forth by the Reserve Bank of India (RBI). She is especially known for her ability to translate complex regulatory requirements into practical solutions that drive business efficiency and minimize compliance risks.

A recognized leader in her field, Swati is a sought-after trainer who regularly leads workshops and seminars for trade professionals, bankers, and corporate clients. Her training sessions focus on trade finance, digitization in banking, FEMA regulations, and compliancebest practices, delivering not just theoretical insights but actionable knowledge that participants can use immediately. Swati’s mission is to empower organizations with the tools,

strategies, and up-to-date expertise needed to execute seamless cross-border transactions, ensure regulatory compliance, and foster sustainable growth.

In today’s dynamic trade and financial environment, Swati stands out for her holistic approach and client-centric philosophy. She believes in equipping businesses with not only knowledge but also practical frameworks and digital tools that help them stay competitive and compliant. Her personalized solutions and unwavering support have made a meaningful impact on the success stories of many organizations.

Why hire

a consultant

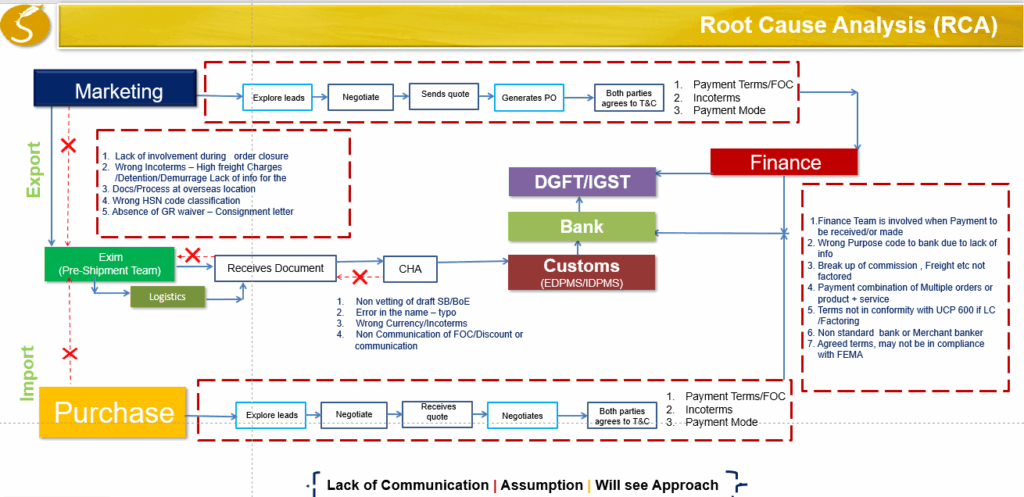

the most common breakdowns in process, compliance, and communication—making a strong case for hiring a FEMA consultant.

Key observations from the chart:

- Multiple Departments Involved: The process spans marketing, purchase, finance, exim, logistics, customs, banks, and regulatory agencies (DGFT/IGST).

- Numerous Pain Points: Breakdowns occur at every stage. Examples include marketing’s lack of involvement during order closure, selection of wrong Incoterms leading to extra charges, errors in HSN code classification, omission of key documents, and communication gaps regarding payment terms or discounts.

- Recurring Compliance Mistakes: Financial and operational errors—such as wrong bank purpose codes, inaccurate freight breakdown, combining orders inappropriately, and terms not in line with UCP 600 or FEMA regulations—can halt payments or lead to regulatory scrutiny.

- Documentary & Procedural Failures: Not vetting shipping bills, typos in names, incorrect currency or Incoterms, and incomplete communication between teams and with banks/customs are recurrent themes.

- Core Root Causes: Lack of communication, reliance on assumptions, and a “will see” mentality lead to costly delays, compliance issues, and possible financial penalties.

Key Observations From the Chart

Multiple Departments Involved

The process spans marketing, purchase, finance, exim, logistics, customs, banks, and regulatory agencies (DGFT/IGST).

Numerous Pain Points

Breakdowns occur at every stage. Examples include marketing’s lack of involvement during order closure, selection of wrong Incoterms leading to extra charges, errors in HSN code classification, omission of key documents, and communication gaps regarding payment terms or discounts.

Core Root Causes

Lack of communication, reliance on assumptions, and a “will see” mentality lead to costly delays, compliance issues, and possible financial penalties

Recurring Compliance Mistakes

Financial and operational errors—such as wrong bank purpose codes, inaccurate freight breakdown, combining orders inappropriately, and terms not in line with UCP 600 or FEMA regulations—can halt payments or lead to regulatory scrutiny.

Documentary & Procedural Failures

Not vetting shipping bills, typos in names, incorrect currency or Incoterms, and incomplete communication between teams and with banks/customs are recurrent themes.

Why hire a FEMA consultant?

A FEMA consultant brings structure, expertise, and proactive oversight to this tangled process. By mapping out every step, a consultant ensures that all stakeholders are involved at the right time, that documents comply with legal/regulatory requirements, and that nothing falls through the cracks due to miscommunication or unclear assumptions.

Consultants analyze and rectify the root causes—like incorrect paperwork, misalignment in financial terms, and late-team involvement—that can damage business outcomes. They create systems for proper vetting, set up documentation standards, and provide training across functions. Their expertise in current regulatory frameworks (such as updated FEMA or RBI guidelines) ensures companies stay compliant, thus protecting cash flows and reputations.

Ultimately, hiring a FEMA consultant drastically reduces risk, enhances efficiency, and ensures seamless, complaint operations for export and import transactions. They bridge the functional gaps, align processes, and enable the organization to focus on scalable, sustainable growth.

A FEMA consultant brings structure, expertise, and proactive oversight to this tangled process. By mapping out every step, a consultant ensures that all stakeholders are involved at the right time, that documents comply with legal/regulatory requirements, and that nothing falls through the cracks due to miscommunication or unclear assumptions.

Consultants analyze and rectify the root causes—like incorrect paperwork, misalignment in financial terms, and late-team involvement—that can damage business outcomes. They create systems for proper vetting, set up documentation standards, and provide training across functions. Their expertise in current regulatory frameworks (such as updated FEMA or RBI guidelines) ensures companies stay compliant, thus protecting cash flows and reputations.

Ultimately, hiring a FEMA consultant drastically reduces risk, enhances efficiency, and ensures seamless, complaint operations for export and import transactions. They bridge the functional gaps, align processes, and enable the organization to focus on scalable, sustainable growth.

We provide personalised solutions that are tailored to the unique needs of each of our clients.

Our Clients

Testimonials

Swati Panji provided excellent FEMA, RBI, and banking advice for Unlink Education Pvt. Ltd. Very professional, practical, and easy to work with. Highly recommended.

Dharmesh Patel

⭐⭐⭐⭐⭐

Swati is excellent in her job. Thorough knowledge, full responsibility, and proficiency in completing work. Truly professional.

Shubhaga INC

⭐⭐⭐⭐⭐

Swati Panji resolved our EDPMS pendency issues with smart and practical advice. Very professional, easy to work with, and highly recommended.

Supriya Nair

⭐⭐⭐⭐⭐

Thank you for resolving RBI and Kalupur Bank issues. Swati’s expertise, persistence, and professionalism brought closure. Truly appreciated.

Mustafa Kanthawala

⭐⭐⭐⭐⭐

Swati’s FIEO eBRC webinar was insightful and practical. Clear guidance on purpose codes, certification, and automation. Valuable for exporters.

Sandesh Ade

⭐⭐⭐⭐⭐

Attended FEMA, EDPMS, IDPMS workshop by Swati Panji. Extremely knowledgeable, insightful, and helpful for exporters and importers.

Viren C. Dayal

⭐⭐⭐⭐⭐

A very good training on IDPMS, EDPMS & FEMA conducted by Princeton. A big shout out to the trainer Ms. Swati for making the session interactive.

Divyanshu Chaturvedi

⭐⭐⭐⭐⭐

Exceptional EDPMS/IDPMS workshop. Ms. Swati Panji’s expertise, engaging delivery, and practical insights made it highly valuable. I strongly recommend.”

Naren Verma

⭐⭐⭐⭐⭐

Thanks to Swati Panji, Princeton Academy Corporate Trainings | 25 Years of Excellence, Airports Authority of India (Central Radio Stores Depot, New Delhi)