Trade Finance

International Seminars and Webinars

We offer :

- Guidance on vetting

- Domestic LC discounting

- Export LC Discounting.

A Letter of Credit (LC) stands as the global gold standard for secure, reliable cross-border payments. At Sriya Enterprise, we help you harness LC facilities to minimize counterparty risk and deliver certainty in your international trade transactions. Our expertise covers the entire LC lifecycle—from advisory on vetting and structuring LCs to practical support for both domestic and overseas dealings. We work closely with your business to draft and review LC terms, ensuring every clause mitigates potential ambiguities and disputes.

Our LC discounting solutions—both domestic and export—empower you to quickly access funds tied up in trade receivables. This means exporters and importers can maintain healthy cash flow without waiting for payment cycles to complete. For exporters, we streamline the discounting of export LCs so you can reinvest in growing your business with confidence, regardless of transaction complexity or global uncertainties.

We also offer guidance on utilizing LCs as a credit enhancement tool, supporting your negotiations with suppliers, buyers, and financial institutions. Our team stays abreast of regulatory changes and best practices, ensuring your company remains compliant and competitive in evolving international markets. Whether you’re new to LCs or looking to optimize your existing arrangements, Sriya Enterprise stands by you as a dedicated partner, reducing financial exposure and driving operational efficiency in every trade deal.

Leverage the power of Letters of Credit with us to unlock new markets, strengthen global relationships, and achieve the seamless movement of goods and funds—backed by safeguards that protect your business at every step.

:max_bytes(150000):strip_icc()/Term-Definitions_letterofcredit-80440d8187244f05afe53827500b72f3.png)

2. Export Finance

Unlock working capital through pre- and post-shipment finance, ensuring you never miss a global opportunity due to funding constraints though Bank Finance

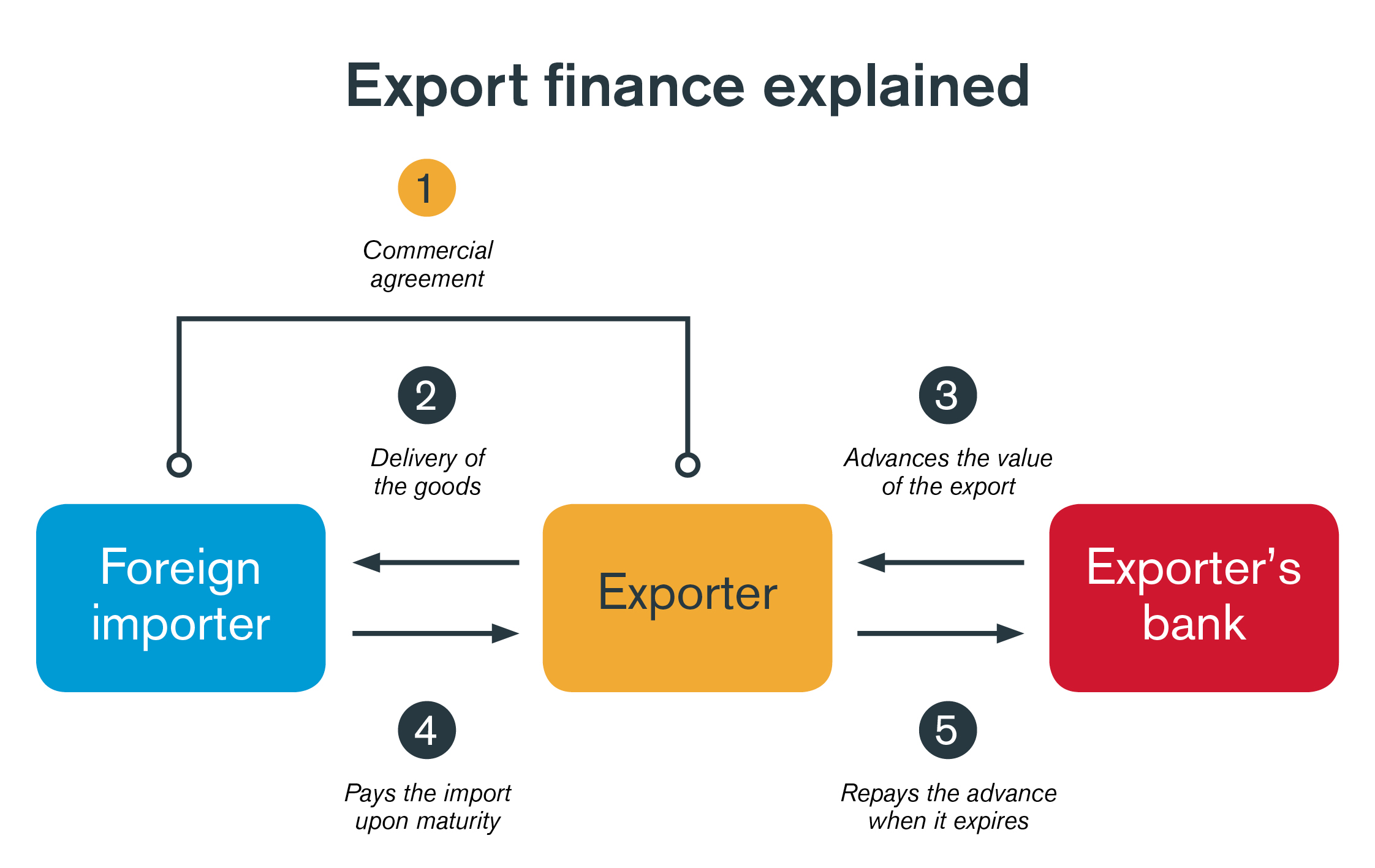

Export finance is essential for ambitious businesses eyeing international markets. At Sriya Enterprise, we help you unlock the working capital required to capture global opportunities without delay. Our expert advisory spans the full spectrum of export finance options, including robust pre-shipment and post-shipment solutions designed to cater to various industry and trade cycles.

We facilitate quick access to bank finance, enabling you to cover production costs, source raw materials, manage inventory, and ship goods without financial strain. Pre-shipment finance ensures you have the liquidity needed to fulfill orders, while post-shipment finance bridges the gap between shipment and final payment, overcoming typical time lags in international transactions.

Our approach is consultative: We assess your unique business needs and help you structure the most effective finance package—maximizing eligibility and minimizing procedural delays. We also advise on document preparation, regulatory compliance, and risk management so that your transactions are smooth, transparent, and fully protected under local and global banking norms.

In a global trade environment prone to volatility, Sriya Enterprise provides stability and foresight. By managing your export finance arrangements with precision and care, we help to accelerate cash inflows, improve budgeting accuracy, and reduce reliance on costly short-term borrowing. This allows your business to focus on market development, innovation, and long-term client relationships, confident in the knowledge that your working capital is secure.

Entrust your export finance needs to us and watch your business gain the agility and momentum needed to capitalize on every international opportunity

3. Supply Chain Finance

:max_bytes(150000):strip_icc()/supply-chain-finance.asp-final-2328998fd43c4a0b8558e28a7d030e44.jpg)

4. Factoring

Convert your trade receivables into immediate cash by selling outstanding invoices to a financial institution (the factor), which is off balance sheet finance not calling for NOC from Bankers. We at Sriya Enterprise are associated with some of the largest and the oldest Factoring Instituions.

This enables you to:

- Improve Cash Flow: Receive up to 80-90% of your invoice value upfront, reducing waiting times on customer payments.

- No Collateral Required: Factoring is based on the creditworthiness of your buyers, so no additional business assets are needed as security.

- Reduce Credit Risk: Non-recourse factoring options transfer the risk of non-payment to the factor, protecting you from bad debts.

- Focus on Core Business: The factor handles collections and receivables management, freeing your resources to concentrate on growth.

- Scalable and Flexible: Funding grows with your sales volume, accommodating seasonal fluctuations and business expansion.

- Fast and Simple: Quicker access to funds compared to traditional bank loans, with streamlined application processes.

Factoring is a transformative solution for businesses seeking to optimize cash flow and drive expansion without increasing debt. At Sriya Enterprise, we offer comprehensive factoring advisory, helping you convert your outstanding trade receivables into instant funds—freeing you from the wait associated with customer payment terms.

With factoring, you can receive up to 80-90% of your invoice value upfront by selling invoices to a financial institution (the factor). Unlike traditional loans, factoring is typically unsecured and is based primarily on the creditworthiness of your buyers. This means you can access the working capital needed for growth without pledging business assets as collateral.

Our services guide you through both recourse and non-recourse factoring options. Non-recourse factoring is especially valuable, as it transfers the risk of non-payment to the factor—shielding your business from the fallout of customer defaults. The factor also assumes responsibility for collecting payments and managing receivables, letting you direct more resources toward your core operations and strategic expansion.

We emphasize transparency and scalability in all factoring arrangements. The amount of funding you receive grows as your sales do, accommodating seasonality and market shifts. Our experts ensure you benefit from fast turnaround times and simple application procedures, giving you a competitive advantage in responding to immediate and long-term business needs.

Experience faster access to cash, minimized credit risks, and improved operational focus. With Sriya Enterprise as your factoring advisor, you gain clarity, flexibility, and security to pursue your ambitions and outperform in the global marketplace.

:max_bytes(150000):strip_icc()/Investopedia_Factor_Final_Blue-1eaca17d9ba34c62a2dcc84521fd1597.jpg)